how to lower property taxes in maryland

The purpose of this program is to help reduce the amount of monies needed at the time of settlement. Maryland Property Tax Rates.

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Downloadable applications are available for most credits and programs.

. Maryland has a property tax rate of 106 which is slightly lower than the national average of 107. Tax bills are rendered for the upcoming fiscal year and are effective as of July 1st. The State of Maryland has developed a program which allows credits against the homeowners property.

Property tax bills are typically. If you have questions please contact Taxpayer Services at. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

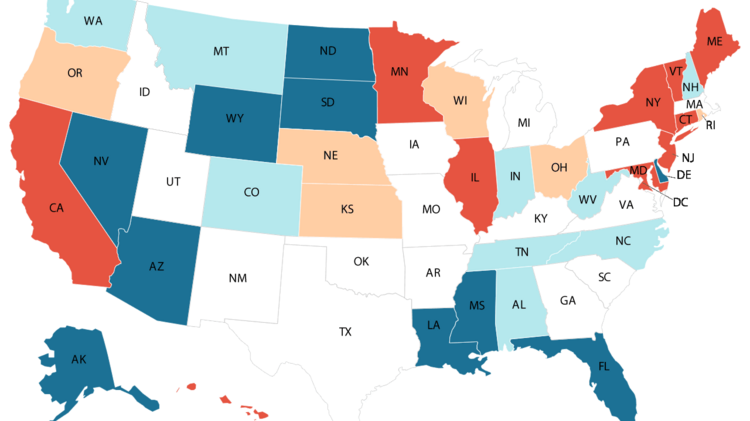

Subsequently Maryland has the 24th highest property tax rate in the country. The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the persons gross income. In other words it sets a limit on the.

See If You Qualify For IRS Fresh Start Program. Ad Based On Circumstances You May Already Qualify For Tax Relief. Property Tax Exemption- Disabled Veterans and Surviving Spouses.

What is the Homeowners Property Tax Credit Program. If your name appears in the listing you should contact the Comptrollers Office to make arrangements to resolve the liability. For more information please call 410-996-2760 or email at sdatperspropmarylandgov.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail. In other words it sets.

Thus for illustration purposes only the county and state property tax rates will be considered here. How can I lower my property taxes in Maryland. While some cities and towns in Maryland impose a separate property tax rate for property in that jurisdiction most agricultural land is not found within those boundaries.

Free Case Review Begin Online. How can I lower my property taxes in Maryland. Property tax bills are issued in JulyAugust of each year by Marylands 23 counties and Baltimore City as well as the 155 incorporated municipalities in Maryland.

Maryland Income Tax Calculator 2021. Tax rates in the county are roughly equal to the state average but are significantly lower than those in the city. The average property tax bill in Maryland ranges between 1403 and 5389.

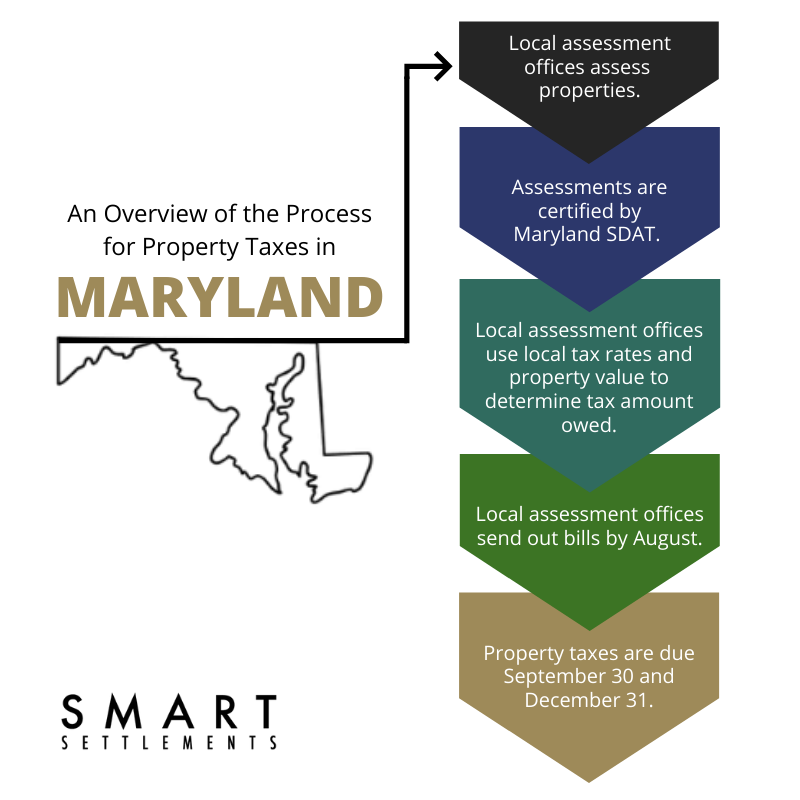

In order to come up with your tax bill your tax office multiplies the tax rate by the. If you make 70000 a year living in the region of Maryland USA you will be taxed 11612. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland.

A lien on your. One of the most efficient methods is the property tax appeal. While the state government handles property assessments in Maryland local governments still set their own tax rates.

If you wish to learn how to file a Maryland property tax appeal. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the property taxes exceed a fixed percentage of the persons gross income.

Taxes are calculated by dividing the taxable assessment by 100. State Property Tax Exemption Benefits. Apply For Tax Forgiveness and get help through the process.

Tax Credits and Tax Relief Programs. So if a propertys market value is determined to be 100000 and the assessment ratio is 80 percent the assessed value for property tax purposes would be 80000. Your average tax rate is 1198 and your marginal tax rate is 22.

4 Guide to the Property Tax Structure in Maryland In 1991 the General Assembly set the homestead assessment cap at 10 for purposes of the State property tax and allowed. When you use UpNest to find the best local Realtors you can be confident that they will provide you with accurate estimates of these taxes. This detailed report tells you everything you.

Learning about actions that can help you reduce property taxes is necessary for every property owner. Your local tax collectors office sends you your property tax bill which is based on this assessment. This detailed report tells you everything you need to know about reduc.

The rates are based on 100 of assessed value taxable assessment. Maryland Property Tax Appeal From A to Z. As is the case with most states Maryland property taxes are primarily a local revenue.

Tax rates are set by the County Council each fiscal year. How can I lower my property taxes in Maryland. Armed Services veterans with a permanent and total service connected disability rated 100 by the Veterans Administration may receive a complete exemption from.

Learn more about each tax credit or tax relief program below. However the state government is. For business tax liabilities call 410-767-1601.

Lifestyles Of Maryland Inc If You Re A Homeowner Struggling To Pay Your Mortgage Or Other House Related Expenses Because Of Financial Hardships Caused By The Pandemic Assistance May Be Available To You

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Tax Land At Higher Rate Than Buildings Study Says It Can Cut Homeowner Taxes Boost Economy Kresge Foundation

States With The Highest Lowest Tax Rates

For State Tax Purposes Is It Better To Live In Virginia Maryland Or Dc Quora

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

A New Group Wants To Slash Baltimore S Property Taxes In The Name Of Equity City Hall Calls It Absurd Baltimore Sun

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Property Tax Calculator Smartasset

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Is The County Council Sneaking In A Tax Hike Seventh State

Tangible Personal Property State Tangible Personal Property Taxes